Blended families are quite common in Michigan. The term “blended family” refers to families consisting of children from previous relationships, or marriages. Of course, this family may include children from the current relationship, or marriage, too. Each family is unique and a variety of configurations exist. For example, one spouse may have a child from a previous marriage and the other spouse has no children. Later, the couple has a child, or children together. In fact, a study by the Pew Research Center shows about 63% of remarried individuals in the United States have stepchildren. As a result, estate planning requires an experienced family law attorney that understands the needs of blended families.

Michigan Estate Inheritance Laws for Blended Families

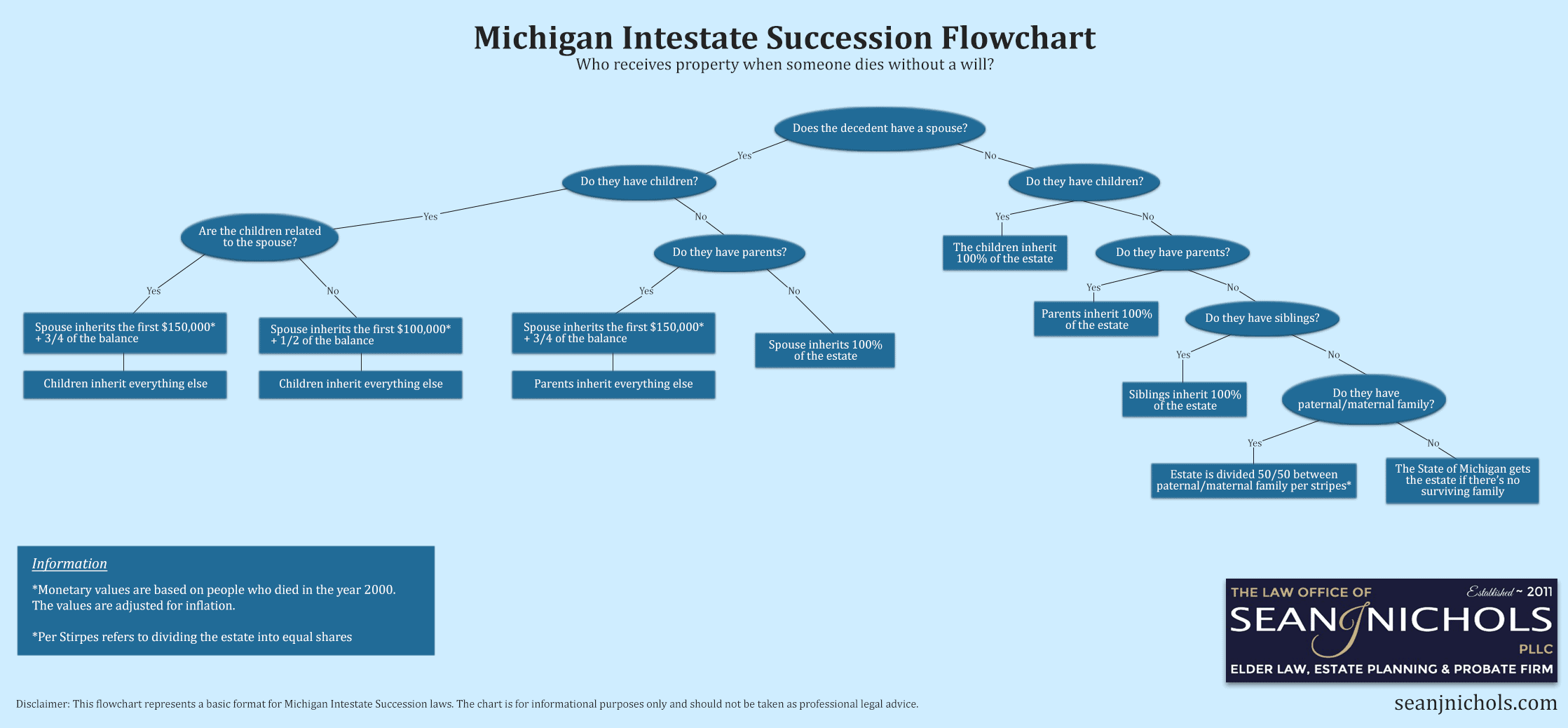

Under Michigan law, if you die without a will or trust, your estate will be handled by Probate Court. The court follows Michigan’s intestate succession laws. Basically, your assets will be distributed to your closest living relatives: spouse, children, parents, siblings, or other relatives. The law does not recognize stepchildren unless they are adopted. This may cause tremendous problems for your family. So, meet with an attorney to establish a sound estate plan that protects the entire family.

How Do I Protect Assets for My Children?

Proper estate planning protects assets and avoids unnecessary taxes. Various steps should be considered:

- Consider a prenuptial or postnuptial agreement- This remains extremely important if you have children from a previous relationship, or marriage. The agreement also preserves and distributes assets accumulated before this new marriage in a designated manner.

- Update your beneficiaries and asset ownership- Beneficiaries override wills and trusts. So, check your life insurance policies, retirement accounts, property titles and any other assets.

- Contact an experienced estate planning attorney- Your Uncle Joe, a business attorney may be a brilliant, nice guy. However, he is not an expert on setting up estate planning documents. Make sure you choose an appropriate attorney.

- Create a will AND trust- Your attorney will explain the importance of a trust document. It avoids probate court and saves your family time and money when you pass away.

Late in Life Marriages and Blended Families

Some folks are living longer. So, in addition to divorce, we have second marriages involving widows and widowers. Believe it, or not, nearly 60 percent of widowed men and less than 20 percent of widowed women remarry within three years after their spouse passes away. This fact presents an added precaution for women and men to protect their children when drafting estate planning documents with current spouse. Consider this example: Leroy and Sandy were married for 40 years and had four children. Over the years, they accumulated considerable wealth and property. Sadly, Sandy passed away after their 40th wedding anniversary. All assets went to Leroy. Well, Leroy was lonely and met Cheri at a widowers’ event. They fell in love and got married. Now, without a prenuptial agreement, Cheri stands to inherit all Leroy’s assets IF the initial estate planning documents with wife #1 left nothing to the children. Sadly, the children are left out. Of course, some couples want this type of arrangement. So, remember an experienced family law attorney protects your family’s future.

Estate Planning Laws

Estate planning laws refer to a set of laws that govern how a person’s assets and properties will be managed and distributed after their death. These laws can vary depending on the jurisdiction, but generally, they encompass the legal instruments and regulations that are used to ensure that a person’s wishes for their estate are carried out and that their heirs or beneficiaries are protected. Estate planning laws typically include rules for creating wills, trusts, and other legal documents that can be used to distribute property, as well as guidelines for probate, estate taxes, and other matters related to estate administration. In addition, estate planning laws may also address issues related to guardianship, conservatorship, and medical decision-making in the event of incapacity or disability.

Estate planning laws are important because they provide a framework for individuals to make important decisions about the distribution of their property and the care of their loved ones after they pass away. By understanding these laws and working with a qualified estate planning attorney, individuals can ensure that their estate planning goals are met and that their wishes are respected.

The law firm of Sean J Nichols, PLLC handles a wide variety of basic and complex estate planning matters in the State of Michigan.