Michigan Inheritance Attorney

A loved one’s death is an emotional time filled with sadness and grief. After the funeral, relatives must sort through many legal and financial obligations. Sometimes, the decedent passes with a will, trust, power of attorney, and all necessary beneficiaries recorded. Other times a person dies intestate, without any will or other necessary legal documentation.

Either way, an inheritance lawyer, probate attorney, or estate planning attorney should guide your family through this complicated process. Since experienced attorneys provide peace of mind regarding wills, trusts, and estate administration, it remains critically important to hire one as soon as possible to protect your family’s interests.

What Happens When There Is No Will?

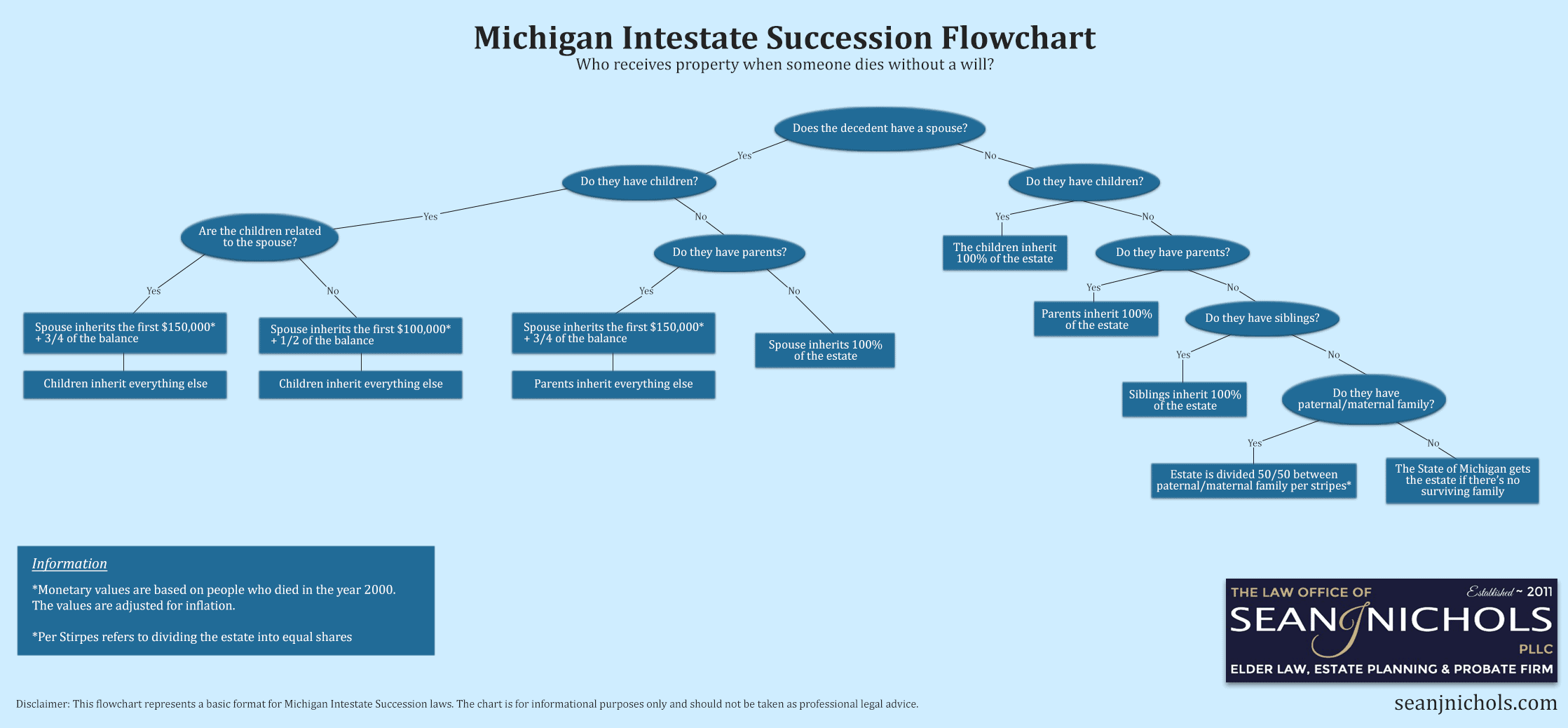

When a person passes away without a will, the estate will go through probate court. The probate process is complicated and requires an experienced attorney’s assistance. Here, the estate is subject to Michigan’s inheritance laws or intestate succession laws. Of course, any assets held in trust, owned jointly, retirement accounts, life insurance, POD bank accounts, or homes are not usually included in probate. Some states automatically give the entire estate to the surviving spouse. However, Michigan handles intestate succession a bit differently.

Naturally, all joint assets, retirement accounts, life insurance, and the home go to the spouse. However, if there are other assets the spouse gets the first $150,000 and half the balance. The children would get the rest. So, it’s important to talk to an attorney if a married person passes away without a will or trust.

Unmarried people that pass away without a will also follow Michigan’s succession laws. If they have children, the estate passes to them first. Next in line are parents, followed by siblings. The estate is split equally among siblings. When there are no living parents, or siblings, the court may look for other relatives. If there are no surviving relatives all assets go to the state. So, it’s important to establish a will and trust to secure your final wishes.

Do I Need an Attorney If There Is a Will or Trust?

If the dearly departed family member has a will or trust it’s a good idea to have an estate planning attorney look it over. If the attorney finds all paperwork in order and your family approves of the estate’s executor, then you may not need an attorney. However, an attorney may help in many ways:

- Faster access to the estate- An attorney may guide the executor through which steps to take first in settling the estate. This prevents future problems.

- Paying debts- An attorney will advise you how long to wait before paying out beneficiaries to ensure all debts are paid.

- Paying taxes- Your lawyer will remind you to pay all taxes on properties and income for the deceased before closing out the estate.

- Conflicts- If any conflicts arise between family members, the attorney may act as a neutral third party.

Will or Trust Disputes

Probate court usually handles estate cases when the decedent had no will or trust. However, sometimes beneficiaries disagree with a will or trust. Other times, folks question the legality of the documents. Here are some possible grounds for vacating a will or trust document:

- Undue Influence– The deceased was coerced into changing or signing a document that altered a previous one. For example, let’s say a parent executed a trust as a 60 year old equally dividing assets among all children. Then one “child” coerced the parent, now an 80+ year old, to disinherit other siblings and leave everything to that one person. That’s an obvious example of undue influence. Many times, these unscrupulous individuals prey on the elderly. The disinherited siblings must act quickly and hire an attorney to throw out the new document.

- Incapacity – Once again, if a person is mentally unable to sign a legal document due to dementia, or mental illness, it may be contested.

- Improper Procedure – Was the will filed with the courts? A trust document does not have to be filed. However, both documents have strict signing requirements.

If you feel a loved one was taken advantage of regarding a will or trust, contact an experienced attorney that specializes in estate planning. These attorneys understand how probate courts operate and they can help. So, for your family’s peace of mind make sure to seek assistance if necessary.