Michigan Trust Attorney

A trust attorney specializes in specific issues related to estate planning and probate that involve trusts. This includes assisting trustees with administration, representing beneficiaries during legal disputes, and more.

Our law firm is experienced in the various legal aspects involved with Michigan trusts. This includes, but is not limited to the following:

- Trust Administration

- Legal Issues and Trust Litigation

- Setting up a Trust

- Special Needs Trusts

- Representing Trustees

- Representing Beneficiaries

Regardless of the complexity of your situation, Sean J Nichols, PLLC has the experience and dedication to provide the best solution for your legal needs.

If you or a loved one need legal guidance with trusts, contact our offices today.

Overview of Michigan Trusts

One main advantage of using a trust is to avoid taxes and probate court. Basically, trusts preserve wealth and control distribution of assets.

One main advantage of using a trust is to avoid taxes and probate court. Basically, trusts preserve wealth and control distribution of assets.

There are numerous types of trusts. A lawyer that specializes in this area of law can advise clients which type works best for their unique situation.

The two main types of trusts are: revocable and irrevocable. In a revocable trust, assets remain in the estate but assets move out in an irrevocable trust. An irrevocable trust may not be changed without the beneficiary’s permission. So, an attorney’s advice is important before deciding which type of trust works best.

Families may find it necessary to establish a special needs trust. This kind of trust protects an inheritance for a beneficiary who may be disabled or unable to handle financial decisions. IRA trusts, life insurance trusts, and charitable trusts are a few of the other vehicles people may utilize when establishing an estate plan.

Generally speaking, life insurance trusts and special needs trusts are irrevocable trusts. However, sound legal advice remains advisable.

Trust Administration

Trust administration involves management of property within the trust in accordance with the document’s terms. This property is managed by the trustees for the benefit of beneficiaries named within the trust.

In Michigan, there are specific duties and legal obligations that trustees must in order to avoid legal issues with trusts in probate court.

As a result, it’s advised to work with an experienced trust attorney in order to help facilitate the administration of a Michigan trust.

Trustee Duties in Michigan

Michigan law covers the duties and liabilities of trustees. Under the Michigan Trust Code (MTC) once a trustee begins distributing assets from an estate, the trustee has accepted the role of trustee and must follow the trust instrument. In other words, a trustee may not change the settlor’s wishes. So, if the settlor wanted the estate to be divided equally among four heirs, the trustee may NOT give a larger portion of the estate to one beneficiary. Hopefully, the settlor chose an honest person as trustee; otherwise, the estate may end up in probate court.

Trustees do not have to accept their fiduciary responsibility. In fact, they are allowed to pass up this opportunity for any reason. For example, a trustee may have moved out of town, or may be ill. In fact, if a trust was written long ago, the trustee may be deceased. In some cases, the trustee may not want to handle all the work involved with settling an estate. So, it’s important to name more than one trustee when writing your trust.

The trustee must distribute all assets within a reasonable time frame and pay all bills to settle the estate. Sometimes a trustee may take too long to distribute assets. Of course, all of the deceased financial obligations and taxes must be paid first. After that, the trustee should disperse monies and sell property as soon as possible.

Also, the trustee should keep records of all financial transactions and share this information with beneficiaries when possible and prudent. Solid record keeping prevents any misunderstandings between beneficiaries. So, if you are appointed trustee of an estate make sure you have knowledge of the grantor’s financial situation and always follow the trust document.

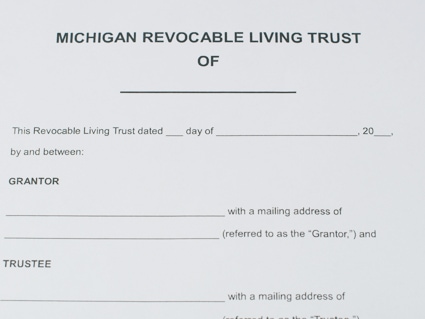

Revocable Living Trusts

The most common trust to have in place is a Revocable Living Trust, also known as “revocable trust,” or “living trust” for short. This trust that can only be changed by the person who has created it and yields several advantage. Advantages of a Revocable Living Trust include, but are not limited to:

- It helps avoid probate court.

- Living trusts lower estate administration costs.

- The document provides protection to the trust’s beneficiaries and is harder to challenge then a will. If you are to fall ill a living trust will keep the assets the trust owns out of probate.

Overall, a properly set up Revocable Living Trust hopes for the best and can handle the worst. It protects you and your heirs if bad life events happen.

Special Needs Trust Attorney

A Special Needs Trust (SNT) is also referred to as a “supplemental needs trust.” Simply put, this trust allows a disabled individual to receive assets/property for their benefit while receiving essential governmental benefits based on individual needs. Special Needs Trusts are a very specialized type of trust, it’s important to have a lawyer for wills and trusts who’s experienced in this specific document draft it for you.

Every parent or grandparent of a disabled child should consider special needs trust planning, whether the anticipated inheritance is large or small. By providing for the child’s extra or supplemental needs, while retaining government benefits, the child’s life can actually be enhanced by the inheritance.

Other Kinds Of Trusts

Apart from revocable and special needs trusts, their are a variety of other types including, but not limited to:

Irrevocable Trust – As the name suggests, an “irrevocable,” or “non-modifiable” trust cannot be changed by the grantor. In other words, the individual who created the trust no longer has control over the document and is bound by provisions defined within the trust.

Asset Protection Trust – Not every State has this type of trust available. In fact, they were only recently allowed in State of Michigan. In short, this is a irrevocable trust that protect assets from creditors, and in some cases, divorce.

Spendthrift Trust – This is another type of irrevocable trust. Simply put, this document helps prevent the beneficiary from the assets until they’re distributed. The laws regarding this document can be highly complex and vary widely from State to State; thus, it’s important to consult a lawyer for questions or concerns on spendthrift trusts.

Charitable Trust – The standard form of this trust is the Charitable Remainder Trust (CRT). As the name implies, these documents are used to make gifts to charities while still receiving benefit yourself. This can be highly beneficial to individuals who own property that is appreciating in value. In other words, this trust helps avoid tax increases through charitable contributions. This trust has several additional variations including: The Charitable Remainder Annuity Trust (CRAT), Charitable Remainder Unitrust (CRUT), and The Charitable Lead Trust (CLT); also known as the Reverse Charitable Remainder Trust.

Michigan Trust Attorney Questions (FAQ)

What is Estate Planning?

Estate planning is the process of anticipating one’s future needs and helps with the distribution of assets after one’s passing. This allows you to minimize costs involved in transferring property to beneficiaries. Specifically, it can minimize gift, estate, and income tax. Further more, this type of planning also avoids unnecessary expenses in probate court. Furthermore, it allows you to choose an executor of your estate. This not only saves you money, it reduces the burden that the death of a loved one places on the living and simplifies administration of the estate.

More importantly, estate planning allows you to plan for a time when you may become incapacitated and unable to make decisions. It allows you to create a plan of action should you become mentally or physically incapacitated. Having a living will or durable healthcare power of attorney in place allows you to choose an individual to help make medical decisions on your behalf.

How Are Wills And Trusts Different?

Wills and trusts are estate planning documents. Both are legal documents in which a person expresses their wishes regarding how their property is to be handled or distributed. These documents may also detail wishes regarding health care needs and/or who will be appointed guardian of one’s children if necessary. All States require that two witnesses be present when signing a will yourself and each page must be signed by the testator (the person making/writing the will). Most people use an attorney to set up their wills and/or trusts. It’s highly recommended to have an lawyer set up your plan, including wills and trusts.

A trust has some advantages over a will. Basically, a trust may save your heirs money by avoiding probate court. Other benefits of a trust include reducing estate and gift taxes. A trust may also provide creditor protection for the inheritance you leave to your heirs…a will can’t do this. A trust can also administer assets for minor children without going to court…a will can’t do this. Finally, a trust can protect governmental benefits for a disabled person…a will cannot. In summary, it’s important to discuss any estate plan with an experienced attorney.

Do Trusts Protect From Creditors, Medicaid, or Nursing Homes?

Some trusts can provide those protections, but most trusts do not. To explain this further, there are two broad types of trusts: Revocable trusts and irrevocable trusts. Revocable trusts are changeable until the death of the trusts’ creator (called a settlor or grantor). Irrevocable trusts are usually unchangeable.

Trusts are containers for assets. Assets are anything you own, whether it’s furniture or the Detroit Lions. So, logically, people (and my clients) prefer to have a revocable (changeable) trust that they control. Almost anyone would prefer to be able to change and manage their trust.

Why would you want a trust that is not changeable and that you do not control?

Revocable trusts are excellent estate planning tools. Revocable trusts can provide tax advantages. Revocable trusts can protect an inheritance for someone too young to spend it, who is terrible with money, or with special needs.

With that said, revocable (changeable) trusts are bad at protecting the creator (settlor/grantor) from creditors. Because a revocable trust is changeable and controllable by its creator (settlor/grantor), it is difficult to successfully argue that a revocable trust protects assets from the creator’s creditors.

Which brings me back to the question of “Why would you want a trust that is not changeable and that you do not control?”

The answer is: these trusts can provide strong protection from your creditors. Irrevocable trusts are tools designed for a specific purpose, such as creditor protection, estate tax planning, nursing home planning, special needs planning, and Medicaid planning.

The creator of an irrevocable trust loses the ability to change and control it. In exchange, the creator receives some protection or advantage that a revocable trust does not have. And, depending on the case, we can have it so the creators of irrevocable trusts can control some parts of them.

What you should take away from this is that trusts are great tools. But, tools only work well if used correctly.

Sean J Nichols, PLLC has written hundreds of trusts and estate plans since 2011 and can help with any issues or concerns pertaining to trusts and estate planning. If you have any questions about trusts, call and schedule a consultation today.

Speak With a Trust Attorney Today

As an experienced trust attorney, Sean Nichols has helped many families with issues related to estate planning and estate litigation in Michigan. These issues include: setting up a new trust, planning for children with special needs, trust administration, legal disputes over trusts, and more.

From the most simple, to the most complex legal issues with wills, trusts, and estate planning, Sean J Nichols, PLLC has the experience and dedication to provide a custom solution that suits your needs.

If you, or a loved one have legal issues pertaining to estate planning or trusts, call us today. (734) 386-0224