Michigan Probate Rules & Processes

Probate is a legal process used for the administration of someone’s assets after death. The process for probate varies depending on which state the individual resides in at the time of death. This article will focus on Michigan probate laws.

Please note, that the information found within this article can serve as a useful guide; however, it should not be considered a substitute for professional legal advice. If you have legal issues related to probate in Michigan, you should contact an attorney that specializes in this area.

Probate Definitions

In order to assist readers with understanding the context of this article, we’ve prepared a list of several definitions found within this page and relevant to probate.

Probate Administration – This refers to the court supervised process of verifying and distributing someone’s assets after they pass away. This is also commonly referred to as estate administration.

Last Will and Testament – Simply put, a Last Will is a legal document which states someone’s final wishes after they pass away. In Michigan, wills are typically required to go through probate with some exceptions (later discussed in the article).

Probate Litigation – Also referred to as “estate litigation,” probate litigation deals with formal legal disputes that arise during the probate process. For instance, someone may contest a will was wrongly modified prior to the decedent’s passing away.

Decedent – Simply put, this refers to someone who has died.

Personal Representative – Someone who’s legally appointed to oversee the administration of an individual’s estate.

Executor – An executor is written in a will to care for a deceased person’s financial obligations.

Trust – Trusts differ from wills in that they don’t go into effect solely when someone passes away. Trusts are established to provide funding for beneficiaries throughout the course of their life.

Trustee – Simply put, a trustee is someone who’s in charge of ensuring the trust is properly administered within established guidelines.

Beneficiary – A beneficiary refers to one (or more) individuals who are written in an estate plan and set to receive a certain amount of assets of an estate after someone’s passing.

Michigan Probate Process & Rules

When someone passes away, probate court proceedings are required when the decedent owns assets that are listed under their name alone.

There are 4 steps to Michigan probate. These are:

There are 4 steps to Michigan probate. These are:

- Appointing the Personal Representative. This person is responsible for gathering the decedent’s assets, paying the debts and taxes, and distributing the inheritance. They are named in the will or by the probate court.

- Assembling the assets. The personal representative will gather, inventory, and safeguard the decedent’s assets. They’ll also have these appraised if and when necessary.

- Paying the bills. All of the decedent’s debts, taxes, funeral expenses, general administration expenses, and creditors must be paid.

- Distributing the remaining assets. The remaining assets are distributed according to the will. If there’s no will, the assets are distributed according to state law.

With that said, there are instances where probate is not required. Here are a few common instances where assets do not require probate in the State of Michigan:

1. Assets owned under “joint tenancy.”

2. Beneficiary designation assets (i.e. retirement accounts with a listed beneficiary)

3. When the decedent has assets named within a trust

There is also a simplified probate procedure for smaller estates. According to Michigan law, this simplified procedure is available if the value of the estate is less than $15,000 after all funeral and burial costs are paid.

Probate can be skipped altogether in cases where the estate is valued as lower than $15,000 and contains no real estate.

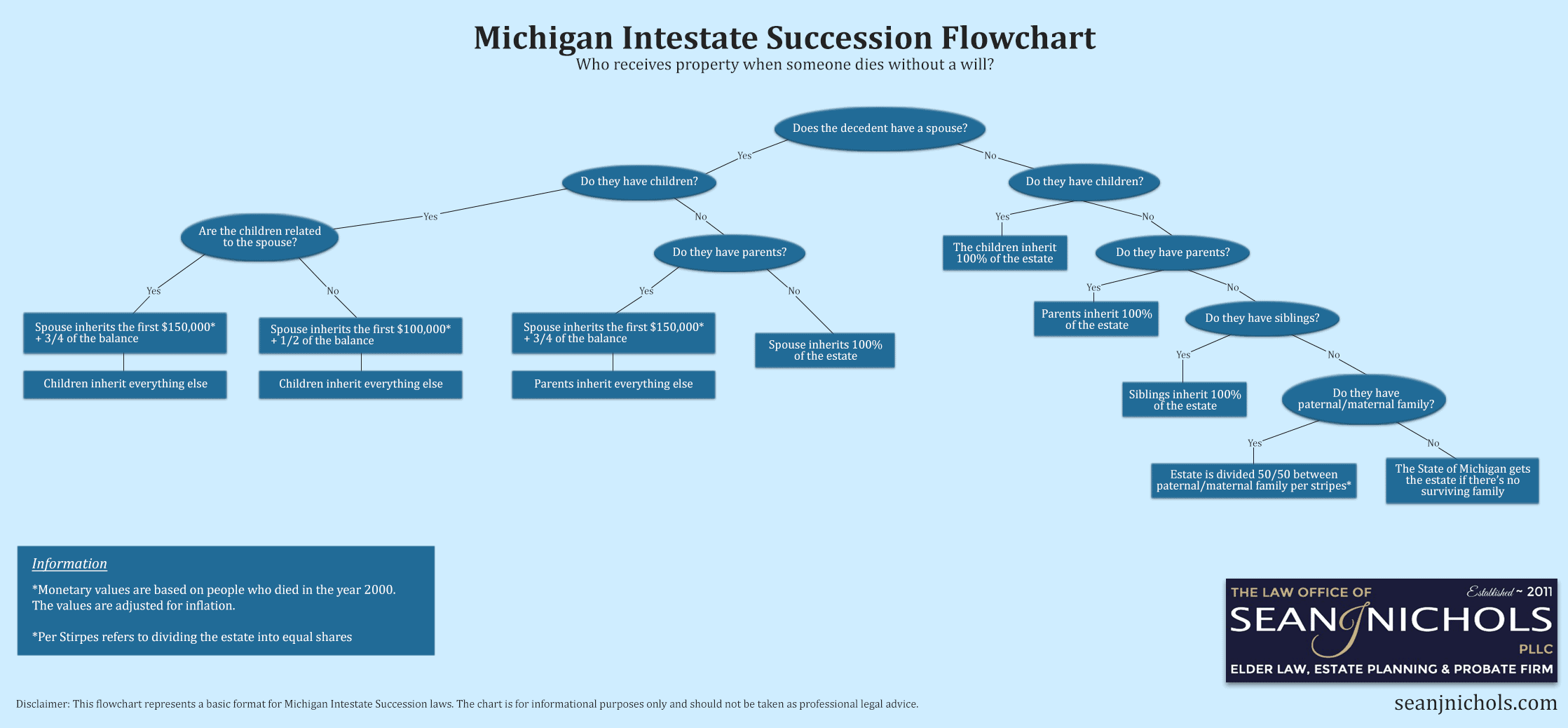

Dying Without a Will in Michigan

In Michigan, a person’s property is generally distributed by the will. But if a person dies without a will, Michigan probate laws defines what happens next.

When someone dies without a will, this is known as “Intestate Succession”

Upon the opening of the probate process, the Michigan probate court will appoint a personal representative for the estate. This person will carry out the same duties that the executor would—had there been a will.

Once this is done the personal representative for the estate must first pay any creditors and remaining debts out of the estate. Once this is handled, the court can begin the process of distributing the estate.

If the deceased was married, an initial amount of $150,000 off of the estate goes to the surviving spouse. If there is a child from both parents (the deceased and the surviving spouse) the spouse also gets half of the remaining balance and the rest is distributed to the child or children.

Michigan’s Legislature Section 700.2102 covers this process and various situations in greater detail.

Types of Michigan Probate

In Michigan, there are several different types of probate proceedings. The type of proceeding that the deceased individual’s estate qualifies for will depend on several factors. These factors include: whether or not the individual passed away with an estate plan, the monetary value of the estate, etc.

Formal Probate – Normally used when an estate is large, complex or is contested by multiple parties. This involves formal probate court proceedings which awards the assets of an estate. It is subdivided into supervised and unsupervised probate depending on the level of oversight required by the court for the personal representative.

Informal Probate – This is a less costly and time consuming option which involves fewer steps than formal probate proceedings. Instead of involving a probate judge, this process is completed in front of a probate registrar. Informal probate still involves a personal representative who administers the estate and handles paperwork that identifies heirs and devisees.

Simplified Probate for Small Estates – For small estates there is a simplified process that bypasses the probate court proceedings almost entirely. As of 2019, only estates valued at or below $23,000 are eligible for this process. Simplified probate handles the assignment of property, transfer by affidavit, collecting money due from employer(s), the transfer of vehicles and collection of personal property.

Probate Without A Will (Intestate Succession) – When an individual passes away without a will, their assets are distributed to the closest family members via the probate courts. This is covered under Michigan’s intestacy laws which dictate who inherits assets and the order of inheritance rights.

Ancillary Probate – This is when probate must be completed in a second or third state outside of the decedent’s primary state of residence. Ancillary probate normally requires a lawyer in the state in which the probate is being executed in order to complete.

Real Estate Probate – If a property is valued below $22,000, a spouse or any surviving heirs can petition a probate court to have the estate probated. For estates valued above $22,000 there is a formal supervised probate process which requires the appointment of a personal representative to distribute the estate.

Vehicle Probate – This is normally included in regular probate proceedings and the vehicle title is assigned by the personal representative. However in the absence of probate proceedings, a vehicle goes to the surviving spouse or the next of kin.

Michigan Probate Laws FAQ

Q. When is probate necessary in Michigan?

In the State of Michigan, probate is necessary when someone passes away while owning property or assets that are listed under their name alone. If the deceased individual has joint ownership over certain property, it’s possible the assets may be transferred to the other owner with little to no court involvement.

Although most property is required to go through probate, there are certain cases where probate isn’t necessary. Examples of assets that don’t need to go through this process include:

- Assets that are held within a trust (i.e Revocable Living Trust)

- Life insurance policies that are listed as payable to a certain beneficiary

- Retirement Accounts and other bank accounts that have a designated beneficiary payable-on-death (P.O.D)

- Property that’s co-owned by another individual via a Joint Tenancy form. This property automatically passes to the other named owner

- Property that’s jointly owned by the deceased person’s spouse per Tenancy by the Entirety Ownership

Q. How do you file for probate in Michigan?

In Michigan, probate is handled by the probate court in which the decedent resided in. Once you determine whether formal or informal probate is required, you must file a petition with the probate court to get the process started.

Q. How Long Does Probate Take?

Most probate cases take between seven months and one year. That timing depends on how quickly the personal representative is appointed.

Creditors and potential contestations also impact timing. Creditors have four months to file a claim. If someone contests the will, this can push the case past the year mark.

You can find more details on the length of probate in regards to creditors in Section 700.3801 of Michigan’s Legislature. According to Michigan law,

“Unless notice has already been given, upon appointment a personal representative shall publish, and a special personal representative may publish a notice as provided by supreme court rule notifying estate creditors to present their claims within 4 months after the date of the notice’s publication or be forever barred…” (Michigan Legislature, 1998, Section 700.3801 Notice of creditors.).”

Q. How Much Does Probate Cost?

The total costs of probate involve the probate court costs, appraisal fees, and executor fees. You will also have to consider attorney fees. However, hiring an attorney can help make the process faster and easier.

Q. Can Probate Be Avoided?

In the case that the estate is valued at less than $15,000, it’s possible to avoid probate and go through a simplified process. In this process, probate courts are involved either not at all or very little.

In addition to the simplified process exception for estates valued at less than $15,000, there are other property exceptions. These include:

- Insurance policies

- Retirement accounts

- Jointly owned property

- Trusts not established by a will

These exceptions will not have to go through probate court.

Q. Do I Need An Attorney?

While Michigan technically doesn’t require an attorney for all probate matters, it’s a good idea to err on the side of caution. Even for straightforward cases when someone passed away with a solid estate plan, a probate lawyer can help ensure correct procedures are followed and avoid potential issues. These legal matters are important and should be treated as such.

On the other hand, certain probate cases absolutely require the assistance of an attorney. This includes cases involving:

Summary

When it comes to Michigan probate laws, there are several key points to keep in mind.

1. There are some conditions where probate may be avoided (i.e. assets in a trust, assets under “join tenancy,” and beneficiary designation assets.

2. Small estates (generally under $15,000), may avoid probate or qualify for a simplified process.

3. When someone dies without a will or estate plan, this is called “Intestate Succession,” which means the probate court(s) need to invoke a specific process to determine who will inherit property of the deceased.

4. Probate is necessary when someone leaves behind property that is solely in their own name.

5. There are four main steps within Michigan’s probate process.

i. Appointing the Personal Representative.

ii. Assembling the assets.

iii. Paying the bills.

iv. Distributing the remaining assets.