Due to the expense of nursing home care some people turn to Medicaid to pay the high costs. Of course, Medicaid has numerous rules and qualifications before this coverage kicks in. In fact, Medicaid has a “countable” asset limit of $2,000. In other words, a nursing home resident and/or spouse must “spend down” or pay for their care until they almost have no money left.

Fortunately, an experienced attorney can guide families through various ways in setting up a Medicaid trust, or another type of trust to safeguard some of their assets. So, it’s extremely important to contact an attorney that specializes in elder law and/or estate planning before applying for Medicaid. It’s also important to note that Medicaid has a five year “look back” period regarding assets.

Types Of Trusts

Basically, when someone applies for Medicaid, all financial transactions over the previous five years are investigated. Thus, a family may not give away large sums of money, or property, to friends/family members in an attempt to hide this information from Medicaid officials. Of course, an elder law attorney may assist families in setting up a medicaid trust to protect assets. Several types of trusts are detailed below.

Revocable Trust – A revocable trust may avoid probate court and you may make changes to the trust at any time. One drawback to a revocable trust is that the assets in the trust are counted by Medicaid when determining eligibility. So, an attorney may not recommend this type of trust for Medicaid planning.

Revocable Trust – A revocable trust may avoid probate court and you may make changes to the trust at any time. One drawback to a revocable trust is that the assets in the trust are counted by Medicaid when determining eligibility. So, an attorney may not recommend this type of trust for Medicaid planning.

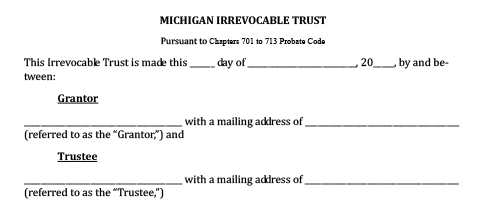

Irrevocable Trust – An irrevocable trust cannot be changed once it is established. Once funds are placed in this type of trust they may not be removed. Property may also be placed in this trust, perhaps for children’s inheritance. For Medicaid purposes, assets in a revocable trust are not “countable assets” if placed there before the five year “look back” period. Medicaid rules are complex and change each year. Therefore, it’s vital to discuss any estate plan with an attorney that specializes in this type of law.

Testamentary Trust – Someone’s spouse may consider establishing a testamentary trust to care for a surviving spouse already in a nursing home. That way, if the “healthy” spouse passes away first, the spouse in the nursing home is properly cared for. This type of trust leaves monies for the institutionalized spouse to cover needs or services not covered by Medicaid. For example, a nursing home patient may need special therapy, legal advice, medical care, etc. Luckily, Medicaid provides for testamentary trusts in case a spouse passes away before their beloved husband/wife in the nursing home.

Special Needs Trust – Special rules protect disabled people under the age of 65. Special trusts may be established to leave funds to assist a disabled child, relative, or friend. Funds may be transferred into a trust for a disabled person without affecting one’s Medicaid eligibility. It’s important to note that when the disabled person passes away, the state must be reimbursed for any Medicaid funds spent on the disabled person. Once again, only an experienced attorney can guide families through the various trusts and how they relate to Medicaid planning.

Learn More About Your Options

Sean J Nichols, PLLC is a 5-star consumer rated law firm specializing in legal issues related to aging. One of the main areas of focus for our practice involves elder law and long term care planning for senior citizens. Our firm helps families find the best options for long term care including: medicaid benefits for nursing home care, veterans benefits, medicare benefits, assisted living, and more. We’ve helped many clients in Michigan with setting up wills, trusts, and other legal matters related to elder care planning.

If you or someone you know would like to learn more about your options regarding Medicaid and trusts contact our offices today.