Everything You Need To Know About a Special Needs Trust

When someone has a child with special needs or is caring for an adult with a physical or mental disability, the thought of leaving this person alone without proper care is frightening. If the person providing care were to suddenly pass away or become incapacitated, there’s a lot of uncertainty as to how the adult or child would receive care. Luckily, with proper estate planning, necessary documents can be established to alleviate these concerns.

This article provides background on a special needs trust (SNT) and how it can provide care for loved ones with special needs throughout their life.

What Is a Special Needs Trust?

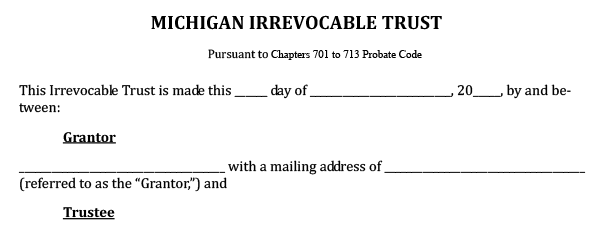

A special needs trust (SNT) is a type of trust set up for a person with special needs. This individual may be physically or mentally impaired and require government assistance. A well drafted SNT provides income for an individual without affecting governmental benefits. This type of trust is an irrevocable legal arrangement and must be established before the beneficiary turns 65. The trust also involves a fiduciary relationship between involved parties.

There are three parties involved in an SNT

Donor. A donor supplies the monies or funds in the trust while alive and as part of an estate after death.

Trustee. A trustee administers the funds according to the donor’s wishes. The trust document usually spells out how the donor wants the funds distributed. A trustee must follow the trust document and prevailing State law to avoid the beneficiary losing government benefits.

Beneficiary. The beneficiary is the person receiving the monies from the trust. The trustee distributes monies from the trust as designated or needed by the beneficiary.

Michigan Special Needs Trust

A Special Needs Trust (SNT) in Michigan is often called Supplemental Needs Trust. Both are legal documents that provide support for your disabled loved one without jeopardizing their governmental assistance. Three parties are involved in a Michigan Special Needs Trust:

Settlor. The person who funds the trust is known as the settlor. This person may place money, stock, property, or other assets into the trust for their physically or mentally disabled family member.

Beneficiary. This person is the disabled individual who receives the proceeds from the trust.

Trustee. The trustee is a person the settlor chooses to disperse the funds to the beneficiary. It’s important to note that Special Needs Trusts may be in effect before and after a settlor passes away. The trustee must be an honest person that will take good care of the beneficiary after the settlor passes away.

Types of Special Needs Trusts

There are three main types of special needs trusts. Different types exist due to regulations regarding Supplemental Security Income (SSI). SSI is a government program that provides financial support to people with physical or mental disabilities that prevent them from working. In order to qualify for SSI, disabled people may not have more than $2000 in their own name. As a result, many families establish these documents as a way to legally supplement their disabled loved ones income.

The three types are explained here:

First-party special needs trust.

This type of trust is used if a beneficiary has more than $2000 in savings, receives an inheritance, or gets a large accident or lawsuit settlement. For example, if a healthy person is injured due to medical malpractice, and can no longer work, they may file a lawsuit. If that person is on SSI and wins the lawsuit, it may be a good idea to place the money in an SNT. Of course, an experienced attorney would provide the best advice in this situation. Since, any funds left in a first-party needs trust go to the government to pay your medical costs after you pass away; this may or may not be the best choice.

Third-party special needs trust

Parents and other family members use this type of trust most often to assist a beloved relative with special needs. Any asset may be placed in this trust. In other words, money, investments, property, stocks and a variety of other funds may be a part of this trust. The best part of the third-party SNT is there is no “payback” provision. In other words, when the beneficiary passes away, all remaining funds go back to the relatives.

Pooled trust

A pooled trust is similar to a first-party trust. The difference is that in a pooled trust a charity establishes the trust. Numerous beneficiaries contribute to the trust while maintaining separate accounts for each beneficiary’s needs. When the beneficiary passes away remaining funds go to the government and to the charity.

Trust Fairness Act

For many years, only family members, or the Court could establish a SNT. However, on December 13, 2016 the Special Needs Trust Fairness Act was signed into law by President Obama. For the first time, a mentally competent, handicapped person could establish their own Special Needs Trust.

This allows a physically handicapped person who inherits money or wins a lawsuit to place funds in a trust. Putting funds in a trust protects the disabled person’s governmental assistance. Since, special needs programs are vital to disabled individuals, this Act provides great protection.

Michigan Special Needs Trust Fund Use

Michigan has strict rules regarding how to use trust monies. If these rules are broken, the beneficiary risks losing SSI support. Trust monies may be dispersed for: medical expenses, cars, education, furniture, occupational therapy, legal fees and other expenses. The Special Needs Trust may not pay for food, housing, or simply give spending cash to the beneficiary. It’s important to check with your attorney to clarify the rules on expenditures and disbursement of funds.

Payback Rules in Michigan

When a beneficiary passes away there may be funds left in the trust. When this happens, families want to know if the remaining monies belong to relatives. This all depends on whether there was a first-party trust or a third-party trust.

In a third-party SNT all remaining money goes to pay bills and then to the family. However, in a first-party SNT the trust must payback Medicaid for all benefits received first. So, trust agreements should be properly structured by an experienced attorney specializing in trusts.